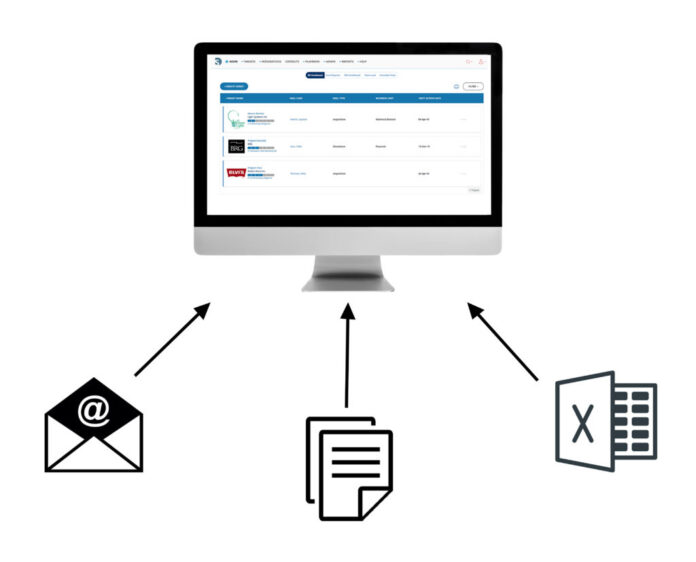

Here we can see “M&A Deal Platform”

Different Types of M&A Tools and Software

In today’s technology world, M&A teams have the chance to utilize various kinds of applications and applications platforms to help them through complex trades. Though many of these programs just came into existence during the previous ten years, they’re altering how prices are coordinated and managed.

Listed below are a couple of M&A tools accessible today to M&A professionals.

1. Virtual Data Rooms

Among the most well-known M&A applications is digital data rooms, also called VDRs. VDRs have existed for almost two years, and now there are scores and scores of VDR suppliers out there. They’re famous for their capacity to safely store confidential information gathered and shared throughout the due diligence procedure.

By way of instance, using a digital data space, investment monies may share crucial data between sellers, buyers, along other third parties, even while remaining in charge of who will view precisely what. Many VDRs stick to stringent security criteria set by FINRA along with the SEC. Therefore all info stored at a VDR is 100 percent protected.

Typically, conventional VDRs are just utilized during due diligence and also insignificance with all Excel trackers.

Popular VDR suppliers include DealRoom, FirmRoom, Merrill Data Website One, Intralinks, Ansarada, Devensoft, Box, Securedocs, Firmex.

2. Excel

Another frequent M&A instrument is Excel. Excel trackers are utilized by M&A professionals to”monitor” the standing of due diligence tasks. Excel trackers frequently have regular due diligence column classes like name, description, category, priority, status, tags, begin date, and thus far.

Each time something was altered or upgraded in an Excel tracker, then the master record has to be updated and shared by everybody. Excel trackers are employed along with VDRs throughout due diligence. By way of instance, after a document was uploaded to some VDR, this item request will then be upgraded and marked as a whole from the Excel tracker. Employing VDR and Excel trackers is a much more conventional way of due diligence.

3. Project Management Tools

Project management has existed for quite a while but has just recently been embraced by the M&A market. However, project direction in M&A isn’t geared towards a particular facet of a bargain towards a group’s general workflows and procedures. M & M&A applications help groups identify and make professional and consistent workflows effective as they can.

Popular Project Management software Providers: DealRoom, Smartsheet, Devensoft.

By way of instance, investment banks possess new interns who always start at predetermined times during the year. Some investment banks utilize project management applications to deal with the interns’ jobs and duties.

4. Pipeline Management Software

Pipeline management applications are a newer alternative and are directed more towards corporate growth M & M&A professionals (Also called corporate development applications ). Business development teams are often managing different M&A prices at one moment and are constantly searching for new opportunities.

The theory behind pipeline management applications is to help corporate development teams manage and organize their continuing and prospective deals. Inside pipeline control applications, sales tend to be grouped with what point they’re in, such as abuse or integration.

Popular Pipeline Management Providers: DealRoom, Midaxo, Enow.

Every deal includes a”charge card” that emphasizes significant essential info relating to this offer. This enables corporate development organizations to handle each of their bargains in 1 spot and helps them fast compare and monitor prices.

5. Diligence Management

Frequent Diligence Management Providers: Central, DealRoom

Diligence direction is just yet another innovative M&A tool and applications. Employing diligence to arrange the due diligence procedure is a more contemporary methodology in contrast to VDRs and Excel trackers. But when used properly, diligence management applications can accelerate the due diligence procedure up to 40 per cent.

Diligence management applications get rid of the requirement to pass an Excel tracker forth and back. It’s all the very exact attributes as a VDR; however, in addition, it comprises a means to control and total diligence requests inside the system. This allows for files to be shared and saved inside the design but enables files to be connected to particular diligence asks, functions to be assigned, as dates place, etc.

6. Post-Merger Integration Management Tools

Well-Known Post-Merger Management Providers: Intralinks, DealRoom, Midaxo

The other M&A tool utilized by specialists would be the post-close integration management computer program. Post-merger management applications’ most crucial thought would be to get post-close integration to finish together due diligence rather than following the deal closes.

This sort of instrument is generally is mix with a non-invasive management system and makes sure the deal info remains available following the agreement is closed for use for future preparation. Throughout diligence, teams may tag things as”post-merger” and make them visible to the proper group members.

7. Collaboration Tools

Another massive benefit of Slack is the variety of integrations accessible, including Salesforce, Dropbox, Twitter, and Zoom. Some M&A tools, such as DealRoom, incorporate with Slack too.

Along with applications created especially for M&A, you will find different instruments used daily by M&A professionals. Many groups rely upon SlackSkype and email for communication functions. Skype is an electronic program that specializes in video chat and voice calls involving various kinds of apparatus. Users may share messages which include text, video, or sound, and the platform’s existed for almost two years.

Slack resembles Skype but has been released ten decades later. It’s a cloud-based immediate messaging platform. Users may even send messages which contain different file types and also make international calls and video chats. Slack provides users with the capability to talk via stations so that every particular project may have its’ station for cooperation.

8. M&A Platform

M&A platforms are made to be a one-stop-shop to get both M&A teams. An M&A Deal Platform combines the characteristics of all of the aforementioned mentioned tools, which consequently creates software intended to be utilized for a whole deal lifecycle.

DealRoom is now the sole M&A instrument and applications, which has features specifically designed for each and each phase of an M&A trade. DealRoom users may perform everything out of diligence, internal job direction, and post-merger intending inside the system.

While each different kind of M&A instrument offers other advantages, and M&A Deal Platform, for example, DealRoom, is the most valuable.

DealRoom prevents groups from having to change back and forth between numerous platforms to handle one deal. DealRoom also enables groups to manage, organize and compare multiple prices in a single centralized place. Users have to understand to use one platform rather than a distinct VDR for every single offer. And among the most significant advantages of utilizing an M&A system, for example, DealRoom is your pricing. DealRoom supplies a flat-rate monthly fee which frequently includes unlimited customers, jobs, and information. Compare this to some VDR that costs per webpage. A bill for a VDR may quickly be $50,000, which as an instrument, for example, DealRoom may come at under $10,000 to get a full calendar year.

Conclusion

There are loads of M&A applications and applications available for M&A groups to select from; the ideal tool only is dependent upon your group’s particular needs. If your customers are older school and much more familiar with a conventional procedure, a VDR and Excel trackers may be a much better match. If you tend to use much more forward-thinking and technology savvy customers, maybe it’s the right time to test a much more comprehensive solution, for example, DealRoom.

The very best thing about fintech’s development and expansion generally is that you will find M&A Deal Platform and software platforms that may improve and streamline your process.