What is an Insurance Stamp | Insurance stamps are a very important part of any business’s operations. An insurance stamp is an official document from an insurance company which indicates that the business has purchased a policy from the insurer. Insurance stamps provide assurance that the business is financially protected against any losses that may occur, such as those related to property damage or personal injury. Knowing what an insurance stamp is and how they work is essential for any business owner. In this blog post, we will explore what an insurance stamp is and how it can help protect businesses.

What is an Insurance Stamp?

An insurance stamp is a type of document that is issued by an insurance company as proof that insurance has been purchased for an individual or business. The purpose of an insurance stamp is to serve as a receipt for insurance premiums that have been paid, and to also provide proof of coverage. An insurance stamp will typically include the name of the insurance company, the policy number, the type of coverage, the amount of coverage, and the date on which the policy was purchased. Insurance stamps are often required by lenders, employers, and other organizations as proof of coverage.

An insurance stamp is a physical stamp issued by an insurance provider, typically through an insurance broker, that shows that a person has purchased an insurance policy. These stamps can be used to prove that a person has insurance coverage in the event of a claim or dispute. They are typically used for automobile, home, business, and health insurance policies. Insurance stamps are generally issued on a yearly basis and need to be renewed annually in order to remain valid. In the event of an insurance claim, the insurance stamp can be used to quickly and easily prove that the policyholder is covered.

How to Get an Insurance Stamp

An insurance stamp is an official document issued by an insurance provider that verifies that an individual has purchased coverage from them. It is usually a small piece of paper or card that is stamped with the company’s logo, the date of purchase, and the type of coverage purchased. Insurance stamps are typically required for certain types of activities, such as operating a motor vehicle or taking out a loan. To get an insurance stamp, an individual must first purchase coverage from an insurance provider. After purchasing the coverage, the provider will issue the insurance stamp to the individual.

The individual must then present the insurance stamp to the applicable organization that requires proof of coverage. The organization will then verify the information on the stamp and will accept it as proof of insurance coverage.

How Do I Get My Registration “stamped”

An insurance stamp is a declaration by an insurance company that a vehicle has insurance coverage. It is typically part of the vehicle registration process, where an individual must show proof of insurance before their vehicle can be registered. To get your registration “stamped,” you must submit proof of insurance from your insurance provider. This proof of insurance may include an insurance card, a policy document, or a receipt for the insurance policy. Once you have that proof of insurance, you can take it to your state’s Department of Motor Vehicles office, or other designated office, and have your registration stamped.

An insurance stamp is a stamp issued by an insurance company that is used to show proof of payment of an insurance premium. These stamps are often placed on documents, such as an insurance policy, to show that the premium has been paid. Insurance stamps are typically used to show proof of insurance coverage for a person or a business. The stamp is also used to indicate the type of insurance policy, the amount of coverage, and the date of payment. Insurance stamps are commonly used by insurance companies to keep track of policyholders and their payments, as well as to provide proof of payment in the event of a claim.

What is an Insurance Stamp for Registration Massachusetts

An Insurance Stamp for Registration in Massachusetts is a proof of insurance card issued by the state’s Division of Insurance to show that a motorist has satisfied the state’s minimum insurance requirements for vehicle registration. The stamp can be obtained from the Division of Insurance or through a licensed Massachusetts insurance agent or broker. The stamp must be presented at the time of vehicle registration and must include the name of the insurance company, the policy number, the effective date of coverage, and the expiration date of coverage. Having the Insurance Stamp for Registration in Massachusetts is important because it ensures that all motorists are covered by the proper insurance in the event of an accident.

An insurance stamp is a physical stamp that’s used to indicate that a person or company has purchased a type of insurance coverage. This could be for health, life, auto, property, or any other type of insurance. The stamp is typically issued by the insurance provider and is used to show that the insurance provider has accepted the policyholder’s premium payment and that the policyholder has the coverage they requested. The stamp is typically affixed to the policyholder’s policy document or other evidence of coverage. Insurance stamps are an important way to verify that the policyholder has purchased the coverage they need.

Insurance Stamp for Registration Massachusetts Liberty Mutual

The Insurance Stamp for Registration Massachusetts Liberty Mutual is a service that allows Massachusetts residents to purchase a required car insurance stamp to register their vehicle. This stamp allows individuals to show proof of insurance to the Registry of Motor Vehicles when registering a vehicle. The stamp is valid for up to 6 months and can be purchased from any Liberty Mutual office in the state. Purchasing an insurance stamp for registration is a quick and convenient way for Massachusetts drivers to ensure that their vehicle is properly insured and registered.

The stamp is also a great way to save money as it is much cheaper than buying a full-year policy. Additionally, it is important to understand that the stamp is not insurance coverage and does not guarantee any payments in the event of an accident. It is simply proof that an individual has purchased the required car insurance when registering a vehicle.

Proof of Insurance Massachusetts Rmv

An insurance stamp proof of insurance Massachusetts RMV is a document that the Massachusetts Registry of Motor Vehicles requires drivers to carry in order to prove that they have automobile insurance. It is a proof of financial responsibility that must be kept in the vehicle at all times, and it must be presented whenever requested by law enforcement. The stamp is provided by the insurance provider, and it must contain the insurance company’s name, policy number, and expiration date. Drivers must renew the stamp every time their policy is renewed, and failure to present a proof of insurance can result in a fine or suspension of the driver’s license.

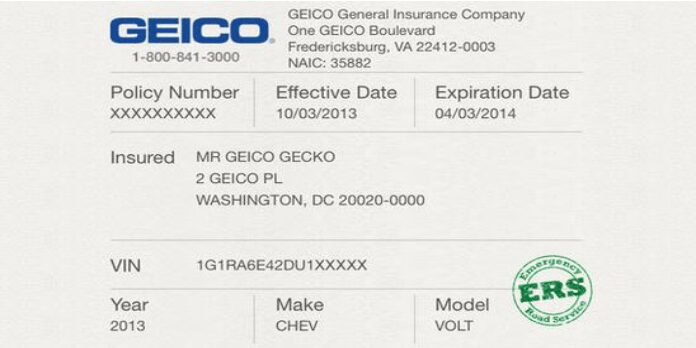

Geico Insurance Stamp

A Geico Insurance Stamp is an online tool that helps you to easily and quickly purchase insurance from Geico. It is a convenient and secure way to purchase and manage your insurance needs. With the Geico Insurance Stamp, you can select from a variety of insurance products, including auto, home, life, renters, and more. You can also manage your policy information, view your policy documents, and more. The Geico Insurance Stamp allows for quick and easy insurance purchases, and makes managing your insurance needs easier and more convenient.

The Geico Insurance Stamp is a great way to get the insurance you need in an easy and secure way. With the Geico Insurance Stamp, you can buy insurance quickly and conveniently, as well as manage your policy information and view documents. You can select from a variety of insurance products and easily purchase the coverage you need. Geico Insurance Stamp is an excellent tool to help you get the insurance coverage you need quickly and easily.

How to Get Geico Insurance Stamp

An insurance stamp is a document that is issued by an insurance company upon the purchase of an insurance policy. It is typically a small piece of paper or card that contains the insurance details, including the amount of coverage, the policy number, and the company name. The stamp is usually placed on the insurance policy itself as a way to ensure that the policyholder and the insurer have a record of the agreement. To get Geico insurance stamp, you need to purchase a policy with Geico. You can do this either online or in person at a Geico office. Once you’ve purchased the policy, you’ll be issued an insurance stamp that will be mailed to you. The stamp will contain all the details of the policy, including the policy number, the amount of coverage, and the company name.

In addition to the insurance stamp, Geico may also issue you a proof of insurance card. This card will contain the same information as the insurance stamp and will serve as a reminder of your coverage. You can keep this card in your wallet or glove box for easy access in the event of an emergency.

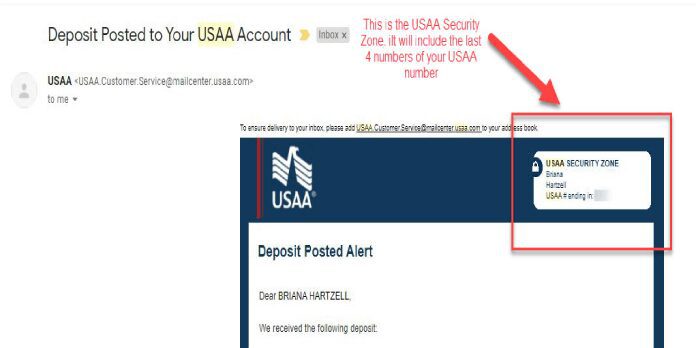

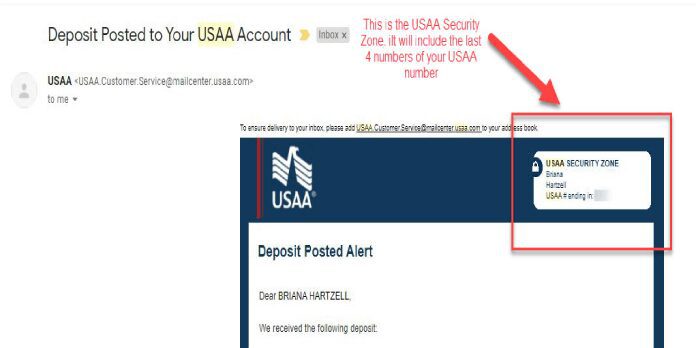

Usaa Insurance Stamp

The USAA Insurance Stamp is a stamp that is issued by the United States Armed Forces to their members and their families. This stamp is designed to provide extra protection against the cost of medical bills and other expenses related to injuries or illnesses. It is available to active members of the military, veterans, and their families, and is typically issued for a small fee. The stamp can be used to provide coverage for medical bills, as well as for home and auto repairs. It can also be used to cover legal fees, if necessary. The stamp is intended to provide an extra layer of protection against the financial burden of unexpected medical expenses.

An insurance stamp is an official stamp used by insurance companies to indicate that a policyholder has paid their premium. The stamp is usually placed on the policyholder’s insurance card, proving that the premium has been paid and that the policy is still in force. Insurance stamps are usually obtained from the insurance company, and each company has its own format for issuing them. These stamps are essential for policyholders to keep their insurance coverage in force, and for insurance companies to ensure that their records are accurate.

How to Get Usaa Insurance Stamp

An insurance stamp is a physical stamp that is used to indicate that the holder of the stamp has a valid insurance policy. Most insurance companies will issue an insurance stamp to policyholders, either in the form of a physical stamp or as an electronic document. In order to get an insurance stamp from USAA, policyholders must first contact a USAA representative and provide proof of insurance. Once the representative verifies the policyholder’s insurance, they will issue an insurance stamp that must be presented whenever proof of insurance is requested.

The insurance stamp must also be presented when purchasing vehicle registrations, registering for certain professional licenses, and when filing certain legal documents. The insurance stamp serves as proof of valid insurance in these situations and allows the policyholder to move forward with their transactions. USAA makes obtaining an insurance stamp simple and convenient, as most policyholders can obtain theirs online or through the USAA app.

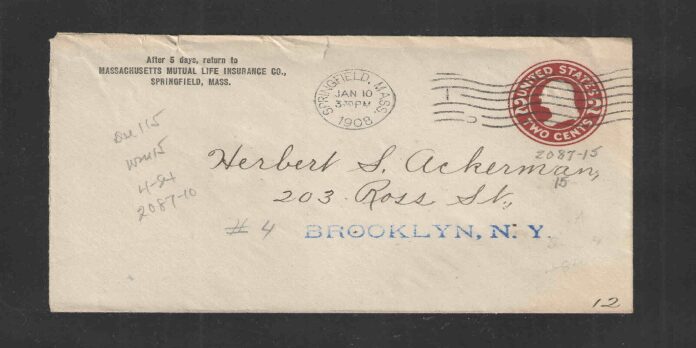

Insurance Stamp Policy and Stamp Samples

An insurance stamp is a form of payment for insurance policies that are issued by an insurance company. It is a physical stamp that is made out of adhesive paper and usually has the name of the insurance company and the policy number printed on it. The stamp can be used to pay for one or more policies, and can be bought from the insurance company or from a third-party vendor. Insurance stamps can also be used to track the status of a policy, as the stamp will display an expiration date or other information. Stamp samples are also available online, which can be used to compare the various policies available from different companies.

Insurance stamps are a convenient and secure way to pay for insurance policies. They provide a paper trail that can be used to track when and where payments have been made, and they can also be used to easily show proof of coverage. They can be used to quickly and easily make payments for multiple policies, and they can be used to track the status of a policy at any time.

How do I get an insurance stamp in MA?

An insurance stamp is an official document that shows proof of an insurance policy’s coverage. In Massachusetts, insurance stamps are issued by the Massachusetts Division of Insurance. To get an insurance stamp, you must first purchase an insurance policy from an authorized insurer, such as an insurance broker or carrier. Once the policy has been purchased, the insurer must provide you with a copy of the policy and the insurance stamp. The insurance stamp will include details about the policy, such as the company name, policy number, effective date and expiration date. The insurance stamp must be presented to the Division of Insurance for verification and approval. Once the insurance stamp is approved, it can be used to show proof of insurance coverage.

Youtube Reference:

1. Insurance stamp mark Retouch

2. Best student medical insurance Ireland Europe 2023 | Stamp 2 & 1G

Conclusion

An insurance stamp is a certificate of proof that a particular person or company has the necessary insurance coverage. By having an insurance stamp, it allows businesses to operate with the peace of mind that their insurance is up-to-date and that they are protected from any potential liabilities. Furthermore, having an insurance stamp can also help to lower insurance premiums for businesses, as it shows that the business is taking the necessary steps to protect itself and its customers.